In 2018 Malaysias gross savings was 267 of its GDP which is markedly lower than Singapores 46 for the same year. In 2018 the highest share of respondents saving any money in the past year was among people between the age of 15 and 24 years with around 73 percent while only about 44 percent of surveyed.

Lotto 6 58 Popular Number Patterns By Results Statistics And Probability Of Winning Winning Lottery Numbers Lottery Numbers Lotto

Malaysias population grew at a slower rate of 17 per cent a year for the period of 2010 and 2020 as compared to 22 per cent a year for the period of 2000 and 2010.

. World Bank national accounts data and OECD National Accounts data files. The latest value for Gross savings current US in Malaysia was 92256080000 as of 2018. Up to 90 of Malaysians are under-insured.

A survey conducted b y Statista Research Department 2019 shows that on a. Department of Statistics Malaysia Consumer Spending in Malaysia averaged 13564226 MYR Million from 2005 until 2022 reaching an all time high of 422452 MYR Million in the first quarter of 2022 and a record low of 56768 MYR Million in the second quarter of 2005. Based on RinggitPlus Financial Literacy Survey from 2020 many Malaysians do not have enough savings to last them more than 3 months.

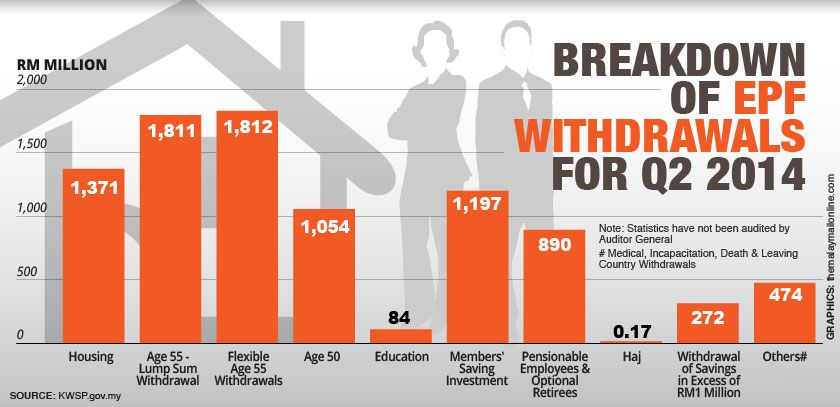

At 67 Malaysians saving habit is one of the highest in the world. Only half of Malaysians have life insurance. More alarmingly as of 2015 a whopping 68 of EPF members aged 54 had savings of less than RM50000.

Likewise fixed deposits grew at a rate of between 564 and 776 from 2015 to 2017 compared with a growth rate of between 696 and 1217 from 2012 to 2014 see Chart 2. A closer look at Bank Negara Malaysia data shows that gross national savings GNS dropped to 249 in 2019 from 267 in 2018 and 292 in 2017. Malaysia - Gross Domestic Savings Of GDP - 2022 Data 2023 Forecast 1960-2020 Historical Malaysia - Gross Domestic Savings Of GDP Gross domestic savings of GDP in Malaysia was reported at 2618 in 2020 according to the World Bank collection of development indicators compiled from officially recognized sources.

The data reached an all-time high of 263 in Mar 2011 and a record low of 227 in Mar 2020. The same applies to saving enough to have a comfortable retirement. The Habit Of Saving.

Click To Tweet 2. World Bank national accounts data and OECD National Accounts data files. RinggitPlus reported there was little improvement in the.

Over the past 44 years the value for this indicator has fluctuated between 101547000000 in 2011 and 1885317000 in 1975. In a survey with over 168000 respondents the Department of Statistics reported that almost half of self-employed Malaysians had lost their jobs due to the Movement Control Order MCO The report which was published yesterday 9 April noted that only 286 of the group had enough savings that can last them for less than a month - 43 had. After deducting 11 from your monthly income and 12 employers contribution into your EPF account you will still need to save about 9 to 10 every month.

We found that female Malaysians tend to save less than males 30 vs 20 and there is a huge difference in the number of men and women who save more than RM1500 a month. However they arent shying away from working hard or making lifestyle changes in order to achieve their savings goals. Given this figure assuming that members spend RM830 per month a total of RM50000 in savings can only last them for five years said EPFs deputy chief executive officer operations Datuk Mohd Naim Daruwish at the unveiling.

The savings for their retirement especially from those in the lower income bracket is considered low even when compared to their peers globally the report added. X Malaysians saving habit is one of the highest in the world Click To Tweet 3. Most of the respondents are savers Most of our respondents 78 said that they have been saving part of their income although 34 of them only started saving one to two years ago.

Gross savings of GDP - Malaysia from The World Bank. Second the release of monthly data covering areas such as the consolidated balance sheet of the Malaysian banking system financial. Gross domestic savings of GDP - Malaysia.

However Malay sian have fallen out of the saving habi ts see Figure 1. At 608 per cent participation in contributory retirement savings institutions is low especially when compared to an aspirational peer group of high-income countries. Almost 9 out of 10 changed their spending habit in order to improve savings.

According to a survey on Malaysian millennials saving behavior conducted in May 2019 37 percent of respondents claimed that the amount of savings that they had was equal to their one months. It must be at least 20 percent. Population of Malaysia.

Private Pension Administrator PPA CEO Datuk Steve Ong has earlier suggested that every Malaysian should save at least 33 of their monthly income for retirement savings. Just 8 of females compared to 19 of males. In order to save enough to retire comfortably in our old age or build up a sufficiently robust investment portfolio that could generate a steady stream of passive income we need to plan our finances wisely and start cultivating the habit of saving monthly.

In Malaysia savings as a percentage of GDP came to 31 on average over that period. According to the Visa Financial Literacy Study 2018 53 of Malaysians are saving to prepare for their futures while 22 do not keep track of their savings and spending. At the same time more Malaysian men own credit cards compared to women 67 vs 46.

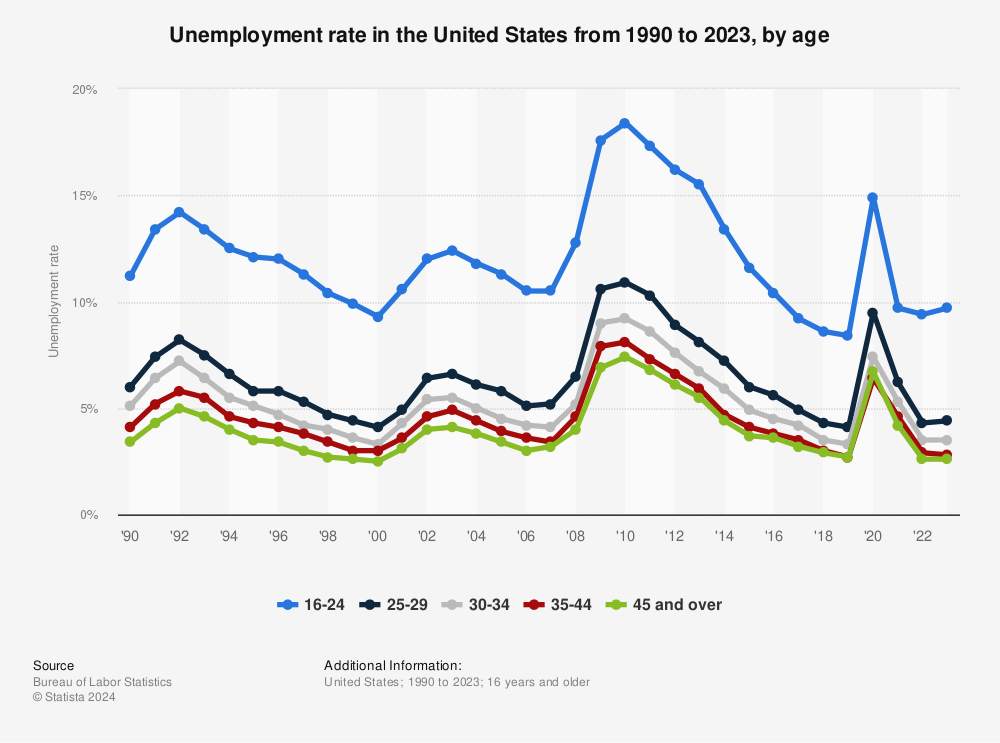

In 1975 there was a 27 percent unemployment rate and a maximum of 39 percent. It also said about 24 of the population avoid keeping a budget. This monthly publication comprises two main components.

The total population of Malaysia in 2020 was 324 million as compared to 275 million in 2010. 101 rows Malaysia Gross Savings Rate was measured at 263 in Mar 2022 compared with 263 in the previous quarter. Five 5 administrative districts recorded a population of.

First the publication of the Monthly Highlights report which features key issues surrounding domestic economic and financial developments for the month. Malaysia Gross Savings Rate is updated quarterly with data available from Mar 2010 to Mar 2022 and an average rate of 263. Looking at these statistics and the spending habits of Malaysian millennials it may not come as a surprise that Malaysians are not saving enough.

Gross savings are calculated as gross national income less total consumption plus net transfers. But savings only went up by 398 to RM14047 billion in 2017 from RM1351 billion in 2016 see Chart 1.

Battle Of The Brands Consumer Disloyalty Is Sweeping The Globe Nielsen Power Of Social Media Infographic Marketing Marketing Tactics

Shocking Statistics Zero Savings Among Malaysian Household Malaysia Insurance Info

Central Michigan University Office Of Study Abroad Nanyang Technological University Nanyang Technological University Central Michigan University Study Abroad

Malaysia Gross Savings Rate 2010 2022 Ceic Data

20 Millennial Spending Habits Statistics That Will Blow Your Mind

Is The Surge In Inflation Here To Stay Deloitte Insights

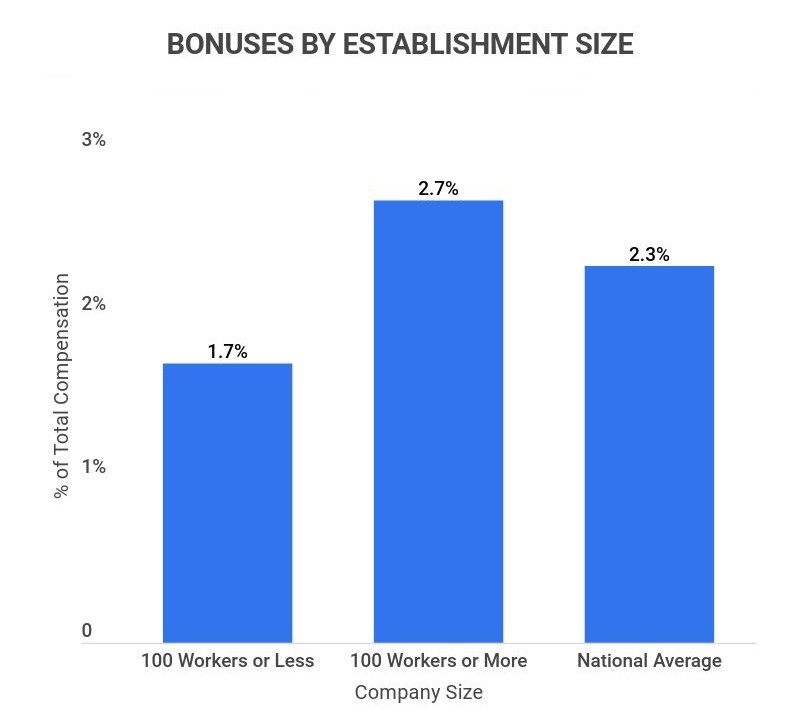

What Is The Average Bonus Percentage 2022 29 Facts And Statistics About Bonuses Zippia

Malaysia Millennials Savings Amount 2019 Statista

Statistical Report On International Assistance 2019 2020

Malaysia Average Monthly Saving 2019 Statista

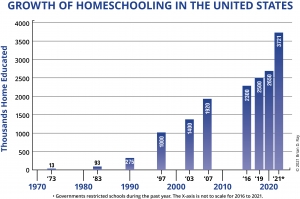

Homeschooling The Research Scholarly Articles Studies Facts Research

Retirement Crisis Brewing As Epf Savings Suggest Pensioner Poverty Malay Mail

Malaysia Number Of Millionaires 2018 Statista

Critical Care Beds Per Capita By Country Google Search Intensive Care Intense Low Country

Is The Surge In Inflation Here To Stay Deloitte Insights

Money Saved In U S Saving Accounts By Gender 2019 Statista

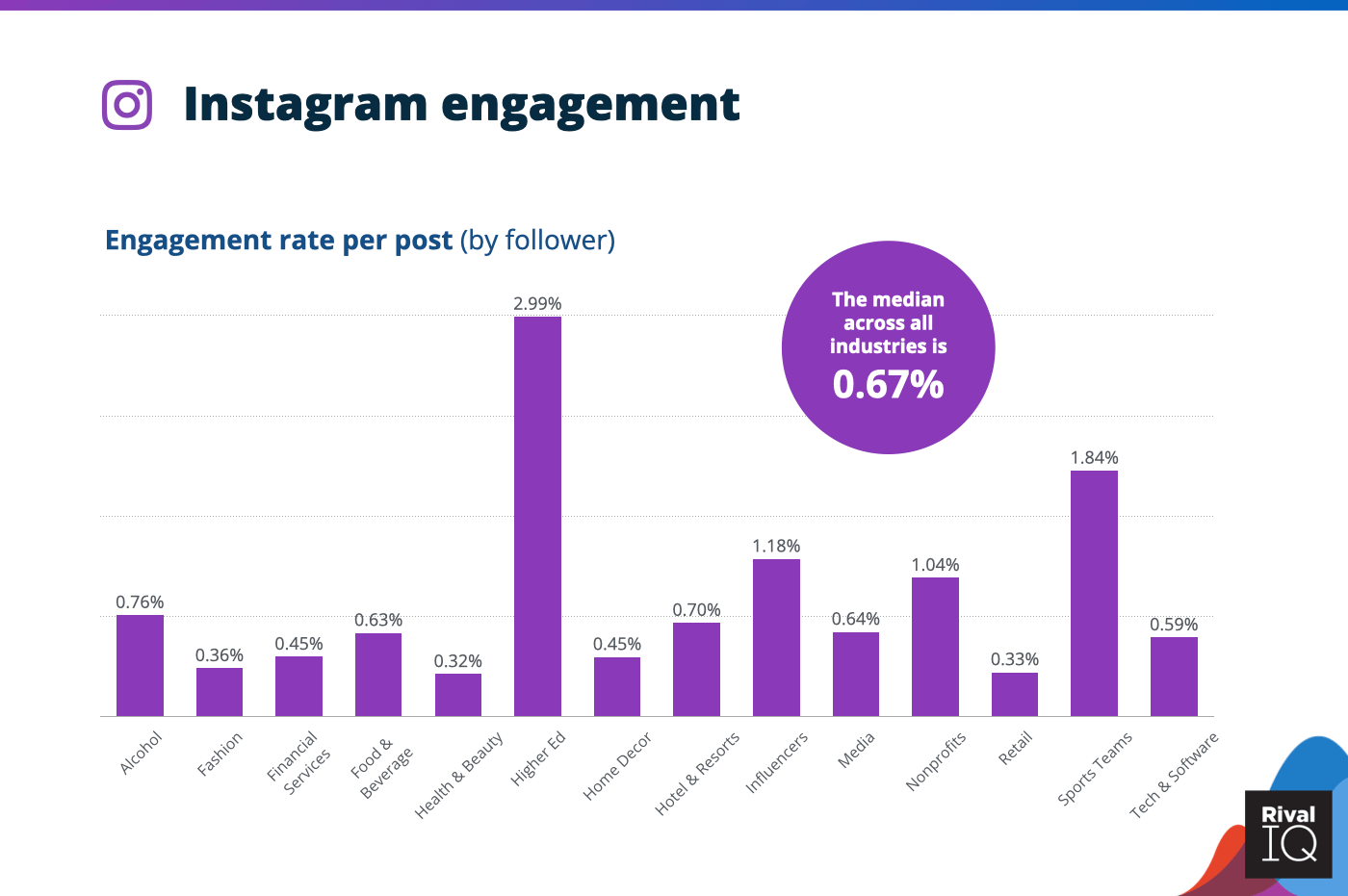

2022 Social Media Industry Benchmark Report Rival Iq

Personal Saving Rate In The U S 1960 2021 Statista